यहाँ Jain Resource Recycling Limited IPO की पूरी जानकारी प्रस्तुत की गई है:

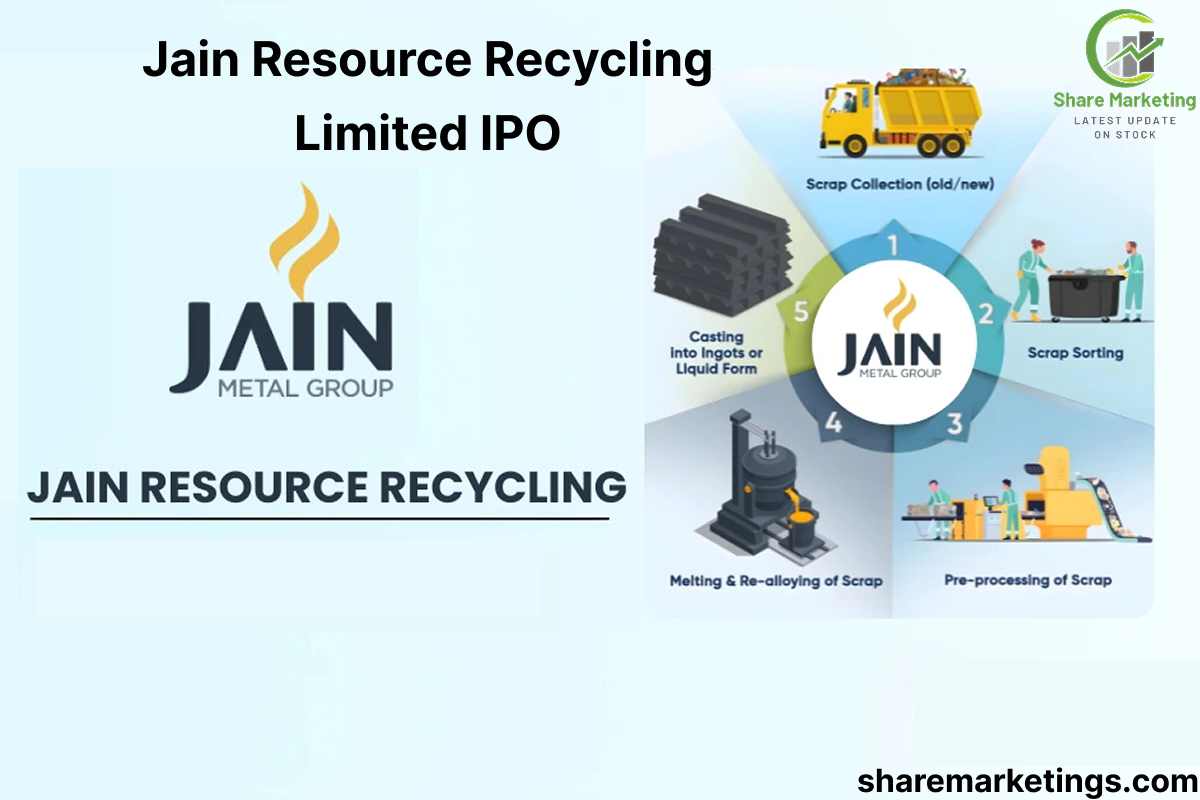

Jain Resource Recycling Limited 2022 में स्थापित एक प्रमुख गैर-लौह धातु पुनर्चक्रण कंपनी है। यह कंपनी लीड, कॉपर और एल्युमिनियम जैसे धातुओं के पुनर्चक्रण और निर्माण में संलग्न है।

इसके उत्पादों का उपयोग बैटरियों, इलेक्ट्रिकल और इलेक्ट्रॉनिक्स, पिगमेंट्स और ऑटोमोटिव उद्योगों में होता है। कंपनी के प्रमुख ग्राहक Vedanta Limited–Sterlite Copper, Luminous Power Technologies, Yash Resources Recycling, Mitsubishi Corporation RtM Japan, और Nissan Trading Co. हैं।

Jain Resource Recycling Limited सीसा, तांबा और एल्युमीनियम सहित अलौह धातुओं के पुनर्चक्रण में विशेषज्ञता रखती है।

कंपनी सीसा और सीसा मिश्र धातु सिल्लियां, तांबा और तांबा सिल्लियां, तथा एल्युमीनियम और एल्युमीनियम मिश्र धातुएं बनाती है।

उनके सीसा सिल्लियां लंदन मेटल एक्सचेंज में पंजीकृत हैं, जिससे वैश्विक विश्वास और मांग बढ़ रही है।

Jain Resource Recycling Limited IPO ₹1,250.00 करोड़ का बुक बिल्ड इश्यू है। यह इश्यू 2.16 करोड़ शेयरों के नए इश्यू (कुल ₹500.00 करोड़) और 3.23 करोड़ शेयरों के ऑफर फॉर सेल (कुल ₹750.00 करोड़) का संयोजन है।

Jain Resource Recycling Limited IPO 24 सितंबर, 2025 को सदस्यता के लिए खुलेगा और 26 सितंबर, 2025 को बंद होगा। जैन रिसोर्स रीसाइक्लिंग आईपीओ के लिए आवंटन 29 सितंबर, 2025 को अंतिम रूप दिए जाने की उम्मीद है। जैन रिसोर्स रीसाइक्लिंग आईपीओ बीएसई और एनएसई पर सूचीबद्ध होगा, जिसकी संभावित लिस्टिंग तिथि 1 अक्टूबर, 2025 तय की गई है।

Jain Resource Recycling Limited IPO का मूल्य बैंड ₹220.00 से ₹232.00 प्रति शेयर निर्धारित किया गया है। आवेदन के लिए लॉट साइज़ 64 है। एक रिटेलर द्वारा आवश्यक न्यूनतम निवेश राशि ₹14,848 (64 शेयर) (ऊपरी मूल्य के आधार पर) है।

sNII के लिए लॉट साइज निवेश 14 लॉट (896 शेयर) है, जिसकी राशि ₹2,07,872 है, और bNII के लिए यह 68 लॉट (4,352 शेयर) है, जिसकी राशि ₹10,09,664 है।

IPO Dates (आईपीओ की तारिंखे )

यहाँ Jain Resource Recycling Limited के आईपीओ (IPO) की महत्वपूर्ण तारिंखे प्रस्तुत की गई हैं:

- Opening Date: 24 सितंबर 2025

- Closing Date: 26 सितंबर 2025

- Basis of Allotment: 29 सितंबर 2025

- Initiation of Refunds: 30 सितंबर 2025

- Credit of Shares: 30 सितंबर 2025

- Listing Date: 1 अक्टूबर 2025

IPO Details (आईपीओ विवरण)

- Face Value: ₹2 प्रति शेयर

- Price Band: ₹220 – ₹232 प्रति शेयर

- Lot Size: 64 शेयर

- Minimum Investment: ₹14,848

- Total Issue Size: ₹1,250 crore

- Fresh Issue: ₹500 crore

- Offer for Sale (OFS): ₹750 crore

- Sale Type: Fresh Capital-cum-Offer for Sale

- Issue Type: Bookbuilding IPO

- Listing At: BSE, NSE

- Share Holding Pre Issue: 32,35,34,090 शेयर

- Share Holding Post Issue: 34,50,85,814 शेयर

GMP of Jain Resource Recycling Limited IPO

Jain Resource Recycling Limited के आईपीओ (IPO) का ग्रे मार्केट प्रीमियम (GMP) लिस्टिंग से पहले ₹11 था, जो लगभग 4.74% की संभावित लिस्टिंग लाभ को दर्शाता है।

लिस्टिंग के दिन, 1 अक्टूबर 2025 को, कंपनी के शेयर ₹265.05 पर सूचीबद्ध हुए, जो ₹232 के आईपीओ मूल्य से लगभग 14.25% की वृद्धि दर्शाता है।

Jain Resource Recycling Limited IPO Lot Size

यहाँ Jain Resource Recycling Limited के आईपीओ (IPO) का Lot Size और उससे संबंधित निवेश विवरण प्रस्तुत किया गया है:

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 64 | ₹14,848 |

| Retail (Max) | 13 | 832 | ₹1,93,024 |

| S-HNI (Min) | 14 | 896 | ₹2,07,872 |

| S-HNI (Max) | 67 | 4,288 | ₹9,94,816 |

| B-HNI (Min) | 68 | 4,352 | ₹10,09,664 |

Jain Resource Recycling Limited IPO Promoter Holding

Jain Resource Recycling Limited के आईपीओ (IPO) के प्रमोटर होल्डिंग की जानकारी निम्नलिखित है:

| Holding Type | Number of Shares | % Holding |

|---|---|---|

| Promoter + Promoter Group (Pre-IPO) | 32,35,34,090 shares | ≈ 89.96% |

| Promoter + Promoter Group (Post-IPO) | 34,50,85,814 shares | ≈ 84.34% |

प्रमोटर होल्डिंग विवरण

- प्रारंभिक होल्डिंग (Pre-Issue): 79.78%

- आईपीओ के बाद होल्डिंग (Post-Issue): 65.87%

About Jain Resource Recycling Limited (कंपनी परिचय)

Jain Resource Recycling Limited एक प्रमुख गैर-लौह धातु पुनर्चक्रण कंपनी है, जो भारत में स्थित है। यह Jain Metal Group का हिस्सा है और 2022 में स्थापित हुई थी। कंपनी का मुख्यालय चेन्नई, तमिलनाडु में स्थित है।

- मुख्य व्यवसाय: गैर-लौह धातुओं जैसे तांबा, सीसा और एल्यूमिनियम के पुनर्चक्रण और निर्माण में संलग्न।

- उत्पाद श्रेणी: सीसा और सीसा मिश्र धातु इन्गॉट्स, तांबा और तांबा मिश्र धातु इन्गॉट्स, और एल्यूमिनियम और एल्यूमिनियम मिश्र धातु इन्गॉट्स।

- उत्पादन क्षमता: वार्षिक 3,08,306 मीट्रिक टन।

- उत्पादन सुविधाएँ: चेन्नई के गुड्डीपोंडी में तीन प्रमुख पुनर्चक्रण संयंत्र।

- वैश्विक उपस्थिति: संयुक्त अरब अमीरात (UAE) के शारजाह अंतर्राष्ट्रीय मुक्त क्षेत्र में एक स्वर्ण परिष्करण सुविधा।

- ग्राहक आधार: Vedanta Limited-Sterlite Copper, Luminous Power Technologies, Yash Resources Recycling, Mitsubishi Corporation RtM Japan, और Nissan Trading Co. जैसी प्रमुख कंपनियाँ।

वैश्विक विस्तार और भविष्य की दिशा (Global Expansion and Future Direction)

- निर्यात: कंपनी का लगभग 60% राजस्व निर्यात से आता है, जिससे यह वैश्विक बाजारों में मजबूत उपस्थिति दर्शाता है।

- भविष्य की योजनाएँ: कंपनी प्लास्टिक, सौर पैनल, ऑटोमोटिव टायर, पीतल ई-वेस्ट और तांबा-एल्यूमिनियम रेडिएटर स्क्रैप जैसे नए पुनर्चक्रण क्षेत्रों में विस्तार करने की योजना बना रही है।

Business / Industry (व्यवसाय / उद्योग)

- Jain Resource Recycling, जैन मेटल समूह का एक हिस्सा है, जो अलौह धातु रीसाइक्लिंग उद्योग पर केंद्रित है। अलौह धातुएँ लोहे के अलावा अन्य धातुएँ हैं, जैसे सीसा, तांबा, एल्युमीनियम।

- कंपनी अलौह धातु स्क्रैप का पुनर्चक्रण करती है और सीसा एवं सीसा मिश्र धातु सिल्लियाँ, तांबा एवं तांबा सिल्लियाँ, एल्युमीनियम एवं एल्युमीनियम मिश्र धातु जैसे उत्पादों का निर्माण करती है।

History & Structure (इतिहास और संरचना)

- इसकी शुरुआत 1953 में हुई थी, जब इसका मूल नाम जैन मेटल रोलिंग मिल्स था। 1993 में इसका पुनर्गठन किया गया।

Operations & Facilities (संचालन एवं सुविधाएँ)

- यह दक्षिण भारत (Chennai / Gummidipoondi) में तीन पुनर्चक्रण संयंत्र और एक पृथक्करण सुविधा संचालित करता है।

- वे अपने कच्चे माल (scrap metals) का एक बड़ा हिस्सा विदेशों से आयात करते हैं। लगभग 77% कच्चा माल Import किया जाता है, और लगभग 23% घरेलू स्तर पर प्राप्त किया जाता है।

Markets, Customers & Exports (बाज़ार, ग्राहक और निकास)

- उत्पादों को भारत और विदेशों दोनों में ग्राहक मिलते हैं। सिंगापुर, चीन, संयुक्त अरब अमीरात आदि जैसे देशों को निर्यात से होने वाले राजस्व का एक बड़ा हिस्सा (कुछ रिपोर्टों के अनुसार लगभग 60% निर्यात) प्राप्त होता है।

- इसके कुछ ग्राहकों में जाने-माने नाम शामिल हैं: वेदांता (Sterlite Copper), ल्यूमिनस पावर टेक्नोलॉजीज, मित्सुबिशी कॉर्पोरेशन, निसान ट्रेडिंग, आदि।

Jain Resource Recycling Limited Financial Information

यहाँ Jain Resource Recycling Limited (JRRL) के वित्तीय प्रदर्शन की जानकारी दी गई है, जो कंपनी के आईपीओ (IPO) के लिये महत्वपूर्ण है।

| Period Ended | 31 Mar 2025 | Mar 31 2024 | 31 Mar 2023 |

| Assets | ₹1,836.24 Crore | ₹1,528.76 Crore | ₹1,115.96 Crore |

| Total Income | ₹7,162.15 Crore | ₹4,484.84 Crore | ₹3,107.53 Crore |

| Profit After Tax | ₹223.29 Crore | ₹163.83 Crore | ₹91.81 Crore |

| EBITDA | ₹368.58 Crore | ₹227.22 Crore | ₹124.18 Crore |

| NET Worth | ₹707.46 Crore | ₹367.18 Crore | ₹196.97 Crore |

| Reserves and Surplus | ₹660.01 Crore | ₹328.13 Crore | ₹161.30 Crore |

| Total Borrowing | ₹919.92 Crore | ₹909.38 Crore | ₹732.79 Crore |

Key Observations

- Strong Revenue Growth: राजस्व 2024 में ~₹4,484.84 करोड़ से बढ़कर 2025 में ~₹7,162.15 करोड़ हो गया, जो लगभग 60% की वृद्धि है।

- Profit Growth: कर-पश्चात लाभ 2024 में ~₹163.83 करोड़ से बढ़कर 2025 में ~₹223.29 करोड़ हो गया।

- EBITDA Increasing: EBITDA में भी मज़बूत वृद्धि देखी गई, जो परिचालन लाभप्रदता में सुधार का संकेत है।

- Assets & Net Worth Expanding: परिसंपत्तियों और निवल संपत्ति दोनों में हर साल वृद्धि हुई है, जिसका अर्थ है कि कंपनी अपने इक्विटी आधार का विस्तार और सुदृढ़ीकरण कर रही है।

- Borrowings Relatively High but Manageable: उधार में वृद्धि हुई है, लेकिन अनुपातहीन रूप से नहीं। कंपनी नए निर्गमों से प्राप्त राशि का उपयोग आंशिक रूप से ऋण चुकौती के लिए कर रही है।

Read More:- Anand Rathi Share & Stock Brokers Limited IPO Details

Key Performance Indicator (KPI)

Jain Resource Recycling Limited के लिए प्रमुख कार्य प्रदर्शन संकेतक (Key Performance Indicators – KPI) नीचे टैबल के रूप में प्रस्तुत किए गए हैं:

| KPI | Values |

|---|---|

| ROE | 40.77% |

| ROCE | 24.22% |

| Debt/Equity | 0.92 |

| RoNW | 41.56% |

| PAT Margin | 3.13% |

| EBITDA Margin | 5.17% |

| Price to Book Value | 20.44 |

Objects of the Issue (Jain Resource Recycling Limited IPO Objectives)

Jain Resource Recycling Limited के IPO (इश्यू) के प्रमुख उद्देश्य (Objects of the Issue)

IPO के उद्देश्य (Objects of the Issue)

- कंपनी द्वारा लिए गए कुछ बकाया ऋणों का पूर्व-भुगतान या निर्धारित पुनर्भुगतान। इस हेतु अनुमानित राशि लगभग ₹375 करोड़ है।

Strengths of Jain Resource Recycling Limited IPO (जैन रिसोर्स रीसाइक्लिंग लिमिटेड के आईपीओ की खूबियाँ)

1) Strong Revenue and Profit Growth (राजस्व और लाभ में मज़बूत वृद्धि)

- कंपनी ने हाल के वर्षों में अपने राजस्व और लाभ में ठोस वृद्धि दर्ज की है, जो व्यवसाय के विस्तार और लाभप्रदता में वृद्धि का संकेत है।

2) Presence in a Critical & Growing Industry (एक महत्वपूर्ण और बढ़ते उद्योग में उपस्थिति)

- अलौह धातु पुनर्चक्रण वैश्विक स्तर पर और भारत में एक महत्वपूर्ण क्षेत्र है, जो अपशिष्ट प्रबंधन, पर्यावरणीय स्थिरता और पुनर्चक्रित धातुओं की माँग में मदद करता है।

3) Large Production Capacity and Facilities (विशाल उत्पादन क्षमता और सुविधाएँ)

- Jain Resource Recycling के पास कई पुनर्चक्रण संयंत्र और एक पृथक्करण सुविधा है, जो इसे बड़ी मात्रा में स्क्रैप को संभालने और कुशलतापूर्वक संसाधित करने की क्षमता प्रदान करती है।

4) Diversified Customer Base, Including Exports (निर्यात सहित विविध ग्राहक आधार)

- कंपनी अपने उत्पादों का एक बड़ा हिस्सा विदेशी बाजारों में निर्यात करती है। इससे केवल घरेलू मांग पर निर्भरता के जोखिम को कम करने में मदद मिलती है।

5) Use of Funds for Debt Repayment (ऋण चुकौती के लिए धन का उपयोग)

- IPO से प्राप्त राशि का एक हिस्सा महंगे ऋण के भुगतान के लिए निर्धारित किया गया है, जिससे ब्याज का बोझ कम हो सकता है, शुद्ध लाभ मार्जिन में सुधार हो सकता है और बैलेंस शीट मजबूत हो सकती है।

Risks of Jain Resource Recycling Limited IPO (जैन रिसोर्स रीसाइक्लिंग लिमिटेड के आईपीओ के जोखिम)

1) Raw Material Price Volatility (कच्चे माल की कीमतों में उतार-चढ़ाव)

- कच्चे माल (scrap metals का एक बड़ा हिस्सा आयात किया जाता है। अलौह स्क्रैप की कीमतें वैश्विक स्तर पर आपूर्ति, शिपिंग और अंतर्राष्ट्रीय मांग के आधार पर उतार-चढ़ाव करती हैं। इससे मार्जिन कम हो सकता है।

2) Foreign Exchange Risk (विदेशी मुद्रा जोखिम)

- चूँकि कई इनपुट आयातित होते हैं और राजस्व में निर्यात शामिल होता है, इसलिए विनिमय दरों में उतार-चढ़ाव लागत और आय दोनों को प्रभावित कर सकता है।

3) Environmental & Regulatory Risks (पर्यावरणीय और नियामक जोखिम)

- रीसाइक्लिंग उद्योग पर्यावरणीय कानूनों, अपशिष्ट प्रबंधन कानूनों और प्रदूषण नियंत्रण मानदंडों के अधीन है। कड़े मानदंडों या अनुपालन में देरी से अतिरिक्त लागत लग सकती है या परिचालन में देरी हो सकती है।

4) Dependency on Export Markets (निर्यात बाजारों पर निर्भरता)

- हालांकि निर्यात एक ताकत है, लेकिन निर्भरता का मतलब अंतर्राष्ट्रीय व्यापार नीतियों, शुल्कों, व्यापार बाधाओं और वैश्विक मांग चक्रों से जुड़ा जोखिम है।

5) High Borrowings / Leverage (उच्च उधारी/लीवरेज)

- कंपनी पर काफी कर्ज है। यद्यपि IPO से प्राप्त राशि से आंशिक रूप से ऋण का भुगतान हो जाएगा, लेकिन उच्च ऋणभार से वित्तीय जोखिम बढ़ जाता है, विशेषकर यदि ब्याज दरें बढ़ जाती हैं या नकदी प्रवाह कम हो जाता है।

Jain Resource Recycling Limited Contact Details

Jain Resource Recycling Limited के संपर्क की जानकारी निम्नलिखित हैं:

पंजीकृत और कॉर्पोरेट कार्यालय

पता:

The Lattice, 4th Floor,

Old No. 7/1, New No. 20, Waddels Road,

Kilpauk, Chennai – 600010,

Tamil Nadu, India

फोन: +91 44 4340 9494

ईमेल: cs@jainmetalgroup.com

वेबसाइट: www.jainmetalgroup.com

निवेशक और मीडिया संपर्क

निवेशक संपर्क:

Bibhu Kalyan Rauta – कंपनी सचिव एवं अनुपालन अधिकारी

ईमेल: cs@jainmetalgroup.com

फोन: +91 44 4340 9494

पता: उपर्युक्त पंजीकृत कार्यालय

मीडिया संपर्क:

T E Narasimhan (Adfactors PR)

ईमेल: te.narasimhan@adfactorspr.com

फोन: +91 98417 34134

पता: उपर्युक्त पंजीकृत कार्यालय

FAQs

Q1. Jain Resource Recycling IPO का इशू साइज़ क्या है?

Ans. Jain Resource Recycling IPO का इश्यू साइज़ ₹1,250.00 करोड़ है.

Q2. Jain Resource Recycling की इंडस्ट्री क्या है?

Ans. Jain Resource Recycling Metal Processing इंडस्ट्री में आता है.

Q3. Jain Resource Recycling कहां लिस्ट किया जाएगा?

Ans. Jain Resource Recycling NSE और BSE दोनों पर लिस्ट किया जाएगा.

Q4. Jain Resource Recycling IPO के लिए प्राइस बैंड क्या है?

Ans. Jain Resource Recycling IPO के लिए प्राइस बैंड ₹220 to ₹232 है.

Q5. Jain Resource Recycling IPO का उद्देश्य क्या है?

Ans. इस IPO का उद्देश्य ताज़ा पूंजी जुटाने के साथ-साथ मौजूदा शेयरधारकों को निकासी का अवसर प्रदान करना है.

Read More:- Solarworld Energy Solutions Limited IPO Detail: Dates, Price & Review

Contact Us

For educational stock market queries only

Stock market investments are subject to market risks.